SkyNRG: Market Outlook of Sustainable Aviation Fuel

Recently, SkyNRG Company released the report "Sustainable Aviation Fuel Market Outlook", which made a comprehensive outlook on the sustainable aviation fuel (SAF) market. By systematically evaluating the announcement of SAF projects and predicting the capacity growth by 2050, it deeply analyzed the current situation and future trends of SAF markets in the EU, Britain, the United States and other parts of the world. This report expands the research scope to the global level for the first time, and introduces the latest policy trends in detail. In particular, Japan, Singapore, India, Brazil, British Columbia, Indonesia and Malaysia have (or are in the process of) enacting relevant laws (or proposals) to promote the wide adoption and application of SAF.

1. SAF prospect in 2030

The report emphasizes that the global SAF market is at an important turning point, since most fuel consumption will be affected by the blending ratio requirements from 2025. According to SkyNRG's forecast, by 2030, SAF production is expected to reach 17.3 million tons (equivalent to 5.7 billion gallons), an increase of 4 million tons compared with the forecast value in 2023, and the total demand will increase to 16.1 million tons.

SkyNRG further pointed out that Brazil, India, Indonesia, Japan, Malaysia and Singapore have put forward legislative proposals to promote the use of SAF in China. At the same time, the EU has formally adopted the legislation of REUEL EUSAF, the UK has also confirmed this legislative plan, and the US has also implemented the mixed tax credit policy. If the policies of these new countries are fully implemented, the global target demand is expected to reach 9.2 million tons by 2030, of which the legal demand is 6.9 million tons. SkyNRG suggested that if major economic systems such as China and the United States make mandatory provisions, the statutory demand may change significantly.

It is estimated that by 2030, the legal SAF demand in the EU will reach 2.8 million tons. According to the market outlook, the renewable fuel production capacity announced so far is expected to supply 3.8 million tons of SAF, and another 5.5 million tons of production capacity is under preparation. This shows that the minimum success rate needs to reach 50% in order to meet the needs of the EU, regardless of imports. SkyNRG warned that there is a trend of continuous delay in the industry in 2024, which may lead to the actual production capacity of SAF being lower than the announced level in 2030.

In the UK, SkyNRG expects the legal demand to be 1.2 million tons by 2030, but the production capacity announced so far is only expected to provide 200,000 tons, which is significantly different from the legal demand. This gap is higher than that of the EU, and SkyNRG is attributed to the high goal setting in the UK and the long-term uncertainty of policy direction.

The report also pointed out that although the SAF target set by the United States is to reach 9.1 million tons in 2030, this demand is unstable due to the short-term nature of the tax relief policy. Up to now, the SAF production capacity announced by the United States is expected to reach 6.7 million tons by 2030, and the announced American factories are facing the challenge of insufficient supply of waste oil and vegetable oil raw materials.

In addition to the European Union and the United States, SkyNRG predicts that Japan will become the main market of SAF, and it is estimated that 1.4 million tons of SAF will be needed in 2030 to meet the announced 10% blending requirement. In terms of output, it is estimated that by 2030, the SAF production capacity in Latin America will reach 2.3 million tons, that in Southeast Asia will reach 1.9 million tons, that in China will reach 1.4 million tons, and that in Japan is only 100,000 tons.

At present, in the announcement of global sustainable aviation fuel (SAF) production capacity, the HEFA route is dominant, and it is estimated that it will account for about 85% of the announced production capacity by 2030. The construction of ethanol-to-aviation fuel (AtJ) facilities is expected to make this technology account for about 8% of the estimated production capacity in 2030, thanks to the commissioning of the first commercial-scale facility and the release of the greenhouse gas (GHG) credit method of the US federal tax. Other technologies (including Fischer-Tropsch synthesis (FT), e-SAF, etc.) still account for a few in the estimated production capacity in 2030, accounting for about 7%.

2. Prospect of sustainable aviation fuel in 2050

According to the report, the growth of SAF is limited by the maximum deployment speed and the availability of raw materials for each path. It is predicted that if the new path risks of biomass raw materials and green hydrogen are alleviated and deployed rapidly in the next few years, the global SAF production capacity will reach about 250 million tons in 2050. In addition, it needs to rapidly develop new raw material supply chains, especially using cover crops and perennial crops to promote the development of the HEFA path, and using municipal solid waste, agricultural and forestry residues to develop the AtJ and gasification+Fischer-Tropsch synthesis (G+FT) path.

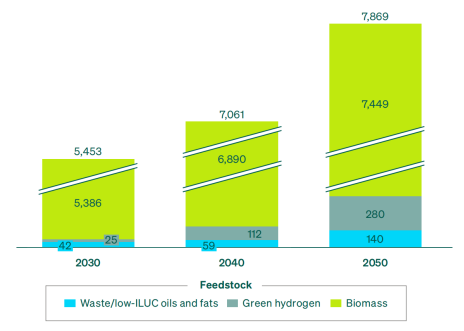

In this report, three kinds of feed streams are focused on: waste/low ILUC oil in the HEFA path, cellulosic materials and municipal solid waste (MSW) in the biomass path (AtJ and G+FT), and green hydrogen in the e-SAF path. The availability of SAF raw materials depends on the total availability of these raw materials, the demand of aviation industry for these raw materials and the SAF output obtained from these raw materials. The report uses public data to estimate the global availability of these raw materials from 2030 to 2050, as shown in the figure below.

3. Development dilemma

According to the report, the deployment of SAF is limited by the development, mainly the investment in SAF infrastructure construction. To meet the production demand of 250 million tons of SAF, 500-800 SAF facilities need to be built. Each facility needs to invest $2 billion, which means that the accumulated investment will exceed $1 trillion. This is equivalent to an average annual capital expenditure of $4 billion from 2025 to 2050, which is roughly equivalent to 8% of the global annual oil and gas capital expenditure in 2019.

The main challenges in the future development also include the uncertainty of raw material supply, especially the difference of green hydrogen and biomass supply in different regions and time periods; Large-scale capital investment is needed to build and operate SAF production facilities; The development of new technology and the improvement of existing technology need a lot of R&D investment and time; And the need for clear and consistent policy support to promote the development and promotion of SAF.

Source:

1.https://skynrg.com/wp-content/uploads/2024/06/SAF-Market-Outlook-2024-Summary.pdf

2.https://mp.weixin.qq.com/s/x1xt4gofBAAIzE1ixXKOeg