The Race for Marine Fuels in the Green Hydrogen Era

Green methanol and green ammonia, as two novel marine fuels, are playing increasingly significant roles in the decarbonization of the shipping industry. Analyzing from multiple dimensions including production capacity, market demand, production technology, and industrial layout, green methanol is more suitable as an alternative fuel for the shipping industry at the current stage due to its mature engine technology. Meanwhile, the zero-carbon attribute of green ammonia makes it an ideal choice for the industry's long-term emission reduction goals.

International shipping, as the primary mode of global trade transportation, emits approximately 1 billion tons of carbon dioxide annually, accounting for about 3% of global CO2 emissions. The International Maritime Organization (IMO) has explicitly set a target of achieving net-zero emissions for international shipping by 2050. Existing battery technology struggles to meet the energy demands of deep-sea shipping. As the cost of renewable energy-based hydrogen production continues to fall, the production costs of green methanol and green ammonia are also decreasing, positioning them as crucial choices for driving the shipping industry's decarbonization.

The global electrolytic hydrogen production sector is developing rapidly. According to the International Energy Agency's (IEA) "Global Hydrogen Review 2025," the planned capacity of announced global electrolyzer projects is about 440 GW. Data from the Hydrogen Energy Branch of the China Industrial Development Promotion Association indicates that by the end of 2025, China had approximately 900 green hydrogen/ammonia/methanol projects in planning or under construction, involving nearly 100 million tons per year of green hydrogen capacity.

Regarding green methanol, based on the global renewable methanol project database tracked by the Methanol Institute (MI), global capacity is projected to exceed 45 million tons per year by 2030. According to statistics from Xiangchenghui Research Institute, by the end of 2024, the planned capacity of low-carbon methanol projects in China had surpassed 50 million tons per year, primarily distributed across the three northeastern provinces and the Inner Mongolia region.

For green ammonia, data from the International Fertilizer Association (IFA) shows that the planned global capacity for green ammonia projects is approximately 75 million tons per year. Statistics from the China Hydrogen Alliance Research Institute reveal that by the end of 2024, the planned capacity for green ammonia projects in China was about 17.8 million tons per year, mainly located in northwestern China.

Green methanol holds advantages in technological maturity, safety, and regulatory standards, with no significant shortcomings. Methanol is liquid at room temperature and pressure, facilitating easy storage and transportation. Engine technology is mature, and existing fuel oil infrastructure can be adapted for its use. Consequently, green methanol-powered vessels have lower investment costs and operational complexity, favoring widespread adoption. A key challenge for the scalability of green methanol is securing affordable and renewable carbon sources for producing e-methanol.

Ammonia combustion produces no carbon dioxide, aligning with the shipping industry's ultimate emission reduction needs. Green ammonia production technology is mature, and the development of renewable energy and the green hydrogen industry provides conditions for its large-scale production. Although green ammonia currently faces challenges in shipping applications, such as immature related powertrain technologies, its prospects are broad. As relevant technologies, products, and standards improve, it is expected that an increasing number of ships will opt for ammonia fuel, aiding the industry in achieving mid-to-long-term emission reduction goals.

Currently, the hydrogen energy industry has entered a new "Green Hydrogen 2.0" phase, with "pan-hydrogen" energy sources like green methanol and green ammonia holding promising prospects. China should fully leverage the abundant wind and solar resources in its western, northern, and northeastern regions to build integrated "green electricity-green hydrogen-green methanol/ammonia" industrial chains and seize development opportunities. By strengthening technological innovation, accelerating demonstration project construction, and improving green product standard systems, China is poised to take a leading position in the global green methanol and ammonia industry, providing strong support for achieving its carbon neutrality goals.

Green Methanol Synthesis Technologies

Biomethanol

Biomethanol has diverse feedstock sources, relatively mature processes, and varied product applications. Main production processes include the biomass gasification-syngas route and the biomass fermentation-methane route.

The gasification route converts biomass into syngas containing carbon monoxide, hydrogen, and carbon dioxide, followed by catalytic synthesis of methanol using catalysts. Key technical challenges include significant variations in feedstock properties, by-product tar production, and fluctuations in syngas quality.

The fermentation-methane route involves producing biogas through microbial anaerobic fermentation, followed by methane steam reforming or partial oxidation to generate carbon monoxide and hydrogen for methanol synthesis. Key technical challenges lie in the stability of anaerobic fermentation and the performance of catalysts for methane reforming along with impurity management.

Regardless of the route used, the large-scale, stable supply of biomass feedstock is a key constraint. Biomethanol projects require rational scale planning to ensure adequate feedstock supply within an economical transportation radius. Biomass gasification coupled with green hydrogen for methanol production is expected to become a mainstream technology for green methanol.

E-methanol

CO2 Hydrogenation to Methanol

CO2 hydrogenation to methanol technology has high maturity but faces challenges such as relatively low methanol yield and high energy consumption. There is a need to develop efficient catalysts to improve reaction rates while reducing energy consumption. Currently, copper-based catalysts are a research hotspot, with metal oxide catalysts and precious metal catalysts also attracting attention. In China, the team led by Academician Li Can at the Dalian Institute of Chemical Physics, Chinese Academy of Sciences, has built China's first thousand-ton scale "Liquid Sunshine" demonstration project, converting solar energy into storable liquid fuel methanol, achieving high methanol selectivity and purity. Iceland's Carbon Recycling International is a global leader in CO2-to-methanol, with a capacity exceeding 200,000 tons per year.

Another process route involves first converting CO2 to syngas via the Reverse Water-Gas Shift (RWGS) reaction, followed by methanol synthesis. Compared to the direct hydrogenation process, the two-step process typically yields higher methanol output but requires reaction temperatures exceeding 800°C, leading to higher energy consumption. It also necessitates two different catalysts and separate reactors, resulting in a more complex process flow.

German electrolyzer manufacturer Sunfire proposed a co-electrolysis technology combining high-temperature electrolysis (Solid Oxide Electrolysis Cell, SOEC) with RWGS, directly converting water and CO2 into syngas in one step, offering higher energy efficiency.

Electrocatalytic CO2 Reduction to Methanol

Electrocatalytic reduction of CO2 to methanol is a promising technology but faces issues such as requiring high electrical potentials, multiple side reactions, and catalyst deactivation. Commercially viable electrochemical CO2 reduction catalysts need to possess high Faraday efficiency and high current density. Existing catalysts do not yet meet commercial requirements. There is a need to develop more effective catalyst materials, as well as design efficient gas diffusion electrodes and modified gas-liquid-solid interfaces.

Green Ammonia Synthesis Technologies

Green Hydrogen-Haber-Bosch Process

The Green Hydrogen-Haber-Bosch process involves producing green hydrogen via renewable energy-powered water electrolysis, followed by catalytic synthesis with atmospheric nitrogen. From the perspective of synthesis principles and technical routes, green ammonia synthesis does not differ significantly from traditional ammonia synthesis. The key to green ammonia synthesis lies in two stages: green hydrogen production and ammonia synthesis. Among these, green hydrogen production accounts for 80-90% of the total cost. Currently, advanced ammonia synthesis processes mostly employ low-pressure synthesis, while the Haber-Bosch reaction temperature remains relatively high, leading to substantial energy consumption. Currently, leveraging its mature technological advantages, the Green Hydrogen-Haber-Bosch process is the dominant route for large-scale green ammonia production.

Electrochemical Synthesis

Given the high energy consumption of the Haber-Bosch process, developing new, efficient, and environmentally friendly ammonia synthesis methods under mild conditions has become a research hotspot in recent years. Although electrochemical ammonia synthesis technologies are still in the R&D stage, their potential is immense and they are expected to become important future methods for green ammonia production.

Electrocatalytic Nitrogen Reduction to Ammonia

Electrocatalytic nitrogen reduction reaction (eNRR) to ammonia utilizes electrochemical methods to reduce inert nitrogen molecules to ammonia via electrocatalysts. It offers advantages like green raw materials and simple processes but remains in the laboratory R&D stage. Main limitations include the extremely low solubility of nitrogen, slow reaction rates at ambient temperatures, and competing hydrogen evolution reactions. There is an urgent need to develop high-stability catalysts and technologies to improve nitrogen utilization, accelerate reaction rates, and suppress side reactions.Lithium-Mediated Nitrogen Reduction to Ammonia

Lithium-mediated nitrogen reduction reaction (Li-NRR) to ammonia is an electrochemical method using lithium as a mediator to reduce nitrogen to ammonia. It is a promising electrochemical method, but its reaction mechanism in non-aqueous systems is not fully understood. Enhancing catalytic activity and stability is key to the industrial application of this technology. Researchers are developing various strategies to improve Li-NRR performance, including potential cycling strategies, adding oxygen promoters, increasing electrode surface area, using gas diffusion electrodes, and employing ionic liquid electrolytes. Li-NRR holds promise for large-scale application due to its ability to generate production currents at the ampere level, potentially rivaling commercial electrolysis systems in the near future.Electrocatalytic Nitrate Reduction to Ammonia

Electrocatalytic nitrate reduction reaction (NtrRR) to ammonia uses electrochemical methods to reduce nitrate to ammonia under the action of a catalyst. The NtrRR process involves multi-electron-proton transfer and complex intermediate evolution, leading to suboptimal reaction selectivity, which is a key constraint. Researchers have developed various strategies to enhance catalyst performance, including crystal facet engineering, alloying, and constructing single-atom sites.Electrocatalytic Nitrogen Oxide Reduction to Ammonia

Electrocatalytic nitrogen oxide reduction reaction (NOxRR) to ammonia utilizes electrochemical methods to reduce nitrogen oxides to ammonia under the action of a catalyst. Compared to the traditional Haber-Bosch process, NOxRR is more environmentally friendly and has broader raw material sources. Copper catalysts have been proven effective for NOxRR.

Strong Demand for Green Alternative Marine Fuels

The European Union has set stringent emission reduction requirements for the shipping industry. The EU Emissions Trading System (EU ETS) has covered commercial ships over 5,000 gross tonnage operating in EU ports since 2024, with the carbon allowance surrender ratio gradually increasing from 40% in 2024 to 100% in 2026. The EU FuelEU Maritime regulation took effect on January 1, 2025, applying to ships over 5,000 gross tonnage. Its greenhouse gas intensity reduction targets increase progressively from a 2% reduction in 2025 (using 2020 as the baseline) to an 80% reduction by 2050.

The International Maritime Organization plans for at least 5%, striving for 10%, of international shipping's energy to come from zero- or near-zero carbon emission fuels/technologies by 2030. Based on estimates of the number of ships over 5,000 gross tonnage and their fuel consumption, the total global demand for green methanol and green ammonia in 2030 could range between 20 and 40 million tons.

According to China Classification Society projections, demand for green methanol will grow rapidly between 2030 and 2040, with an estimated 350-400 million tons by 2040. Meanwhile, demand for green ammonia is expected to grow rapidly post-2040, reaching an estimated 330 million tons by 2050.

Green Methanol as a Marine Fuel

Green methanol offers convenient storage and transportation and excellent combustion properties. Its lifecycle carbon emissions are significantly lower than those of traditional marine fuel oils. Only simple modifications to existing bunkering facilities are needed to enable green methanol supply. Although green methanol can be corrosive to certain ship materials, its excellent biodegradability and water solubility minimize its environmental and human health hazards.

Marine methanol engines are a key technology for promoting the large-scale application of methanol fuel. In the two-stroke methanol engine domain, Everllence (formerly MAN Energy Solutions)'s ME-LGI engine has taken the lead in commercial application, accumulating over 120,000 operational hours across multiple vessels, providing strong proof for methanol fuel's adoption in shipping. Four-stroke methanol engines are a key R&D focus for major engine manufacturers. Wärtsilä successfully converted a ferry to methanol power and is poised to launch commercial methanol engines. Zichai Power successfully developed a four-stroke Z6170 methanol engine employing methanol-diesel dual-fuel combustion technology, achieving a methanol substitution rate of around 40%.

The global green methanol bunkering network is increasingly complete. Currently, over 100 ports have supply capability, with more than a dozen having bunkering capability. On September 23, 2025, Sinopec Fuel Oil Company completed the shore-based bunkering of 300 tons of domestically produced green methanol for the world's first methanol dual-fuel car carrier, the "Gang Rong," at the Tianjin Port Global Ro-Ro Terminal.

According to data from DNV's Alternative Fuels Insight (AFI) platform, global orders for alternative-fueled vessels increased significantly in 2024, reaching 515 vessels, a 38% increase from 2023. Among these, methanol-fueled vessel orders reached 166, while ammonia-fueled vessel orders were 27. As of November 2025, globally, 95 methanol-powered vessels were in operation, with 355 under construction.

Green Ammonia as a Marine Fuel

Green ammonia, as a zero-carbon fuel, has relatively poor combustion characteristics and a low fire risk but requires new fuel bunkering facilities. Ammonia's high toxicity poses serious threats to crew health, the marine environment, and ship equipment. Ammonia-fueled engines not only emit significant nitrogen oxides (NOx) but may also produce the potent greenhouse gas nitrous oxide (N2O) and lead to ammonia slip. The impacts of ammonia production, transportation, and use on climate and the environment require further in-depth study. Reactive nitrogen emissions from ammonia combustion could potentially fully offset its carbon reduction benefits. Therefore, efficient after-treatment technologies need to be developed, leakage minimized, and strict monitoring systems established.

Currently, several ammonia-fueled vessels are in operation globally. Australia's Fortescue converted an offshore support vessel into the world's first ocean-going ammonia-powered ship, having completed sea trials. NYK Line's first pilot ammonia-fueled tugboat completed its initial ammonia bunkering. On June 28, 2025, the world's first pure ammonia-fueled internal combustion engine-powered demonstration vessel, the "Amhui Hao," successfully completed its maiden voyage on Chaohu Lake in Hefei, Anhui Province. On July 25, 2025, the world's first green marine ammonia fuel bunkering operation was successfully completed at Dalian COSCO Shipping Heavy Industry Shipyard, conducted by Sinopec & China Shipping Marine Fuel Supply Co., Ltd., for an ammonia-powered port operation vessel. By the end of 2025, China's first ammonia-hydrogen internal combustion engine range-extended hybrid power vessel, built by FZJT Hynergy Technology Co., Ltd., successfully completed trial voyages in the coastal waters of Fu'an City.

The widespread application of ammonia fuel is highly dependent on engine technology. Wärtsilä has taken the lead in launching a four-stroke medium-speed marine ammonia-fueled engine, the W25, with power ranging from 1,900 to 3,100 kW. In the two-stroke low-speed engine domain, Everllence's first ME-LGIA engine is expected to be officially delivered in the first quarter of 2026. By the end of 2025, CSSC's first X72DF-A ammonia-fueled low-speed engine successfully achieved stable full-load operation in ammonia fuel mode.

Comparison between Green Methanol and Green Ammonia

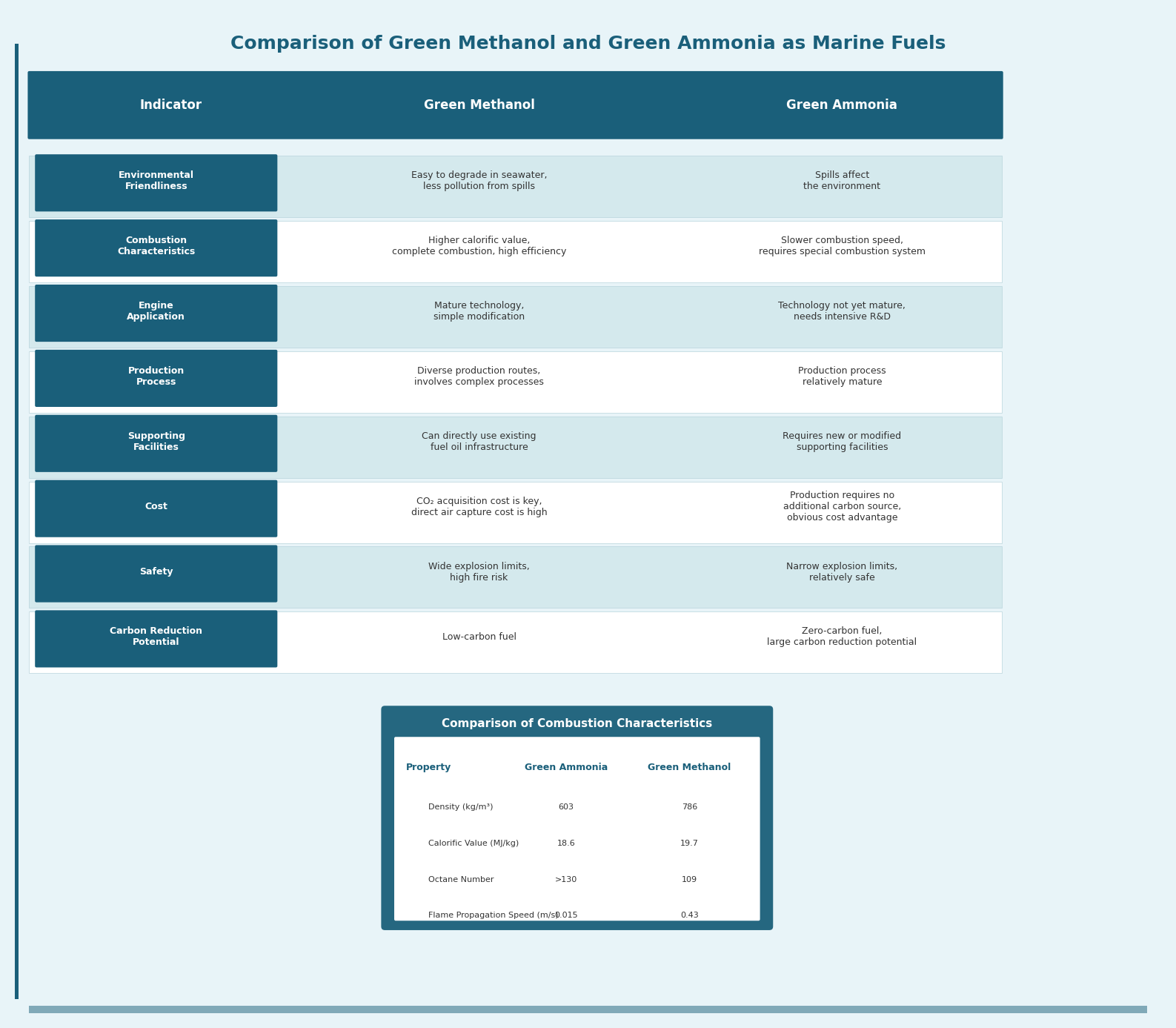

From an environmental friendliness perspective, green methanol holds an advantage, being easily soluble and biodegradable in seawater.

Regarding combustion performance, green methanol is superior, with higher calorific value and more stable, efficient combustion.

In terms of engine technology, methanol engine technology is relatively mature, and retrofitting existing oil-fueled engines is simpler. Ammonia engines face technical challenges in ignition and combustion due to ammonia's special properties, requiring more R&D investment.

Looking at production processes, green ammonia is relatively mature, achievable by substituting traditional fossil feedstocks with green hydrogen. Green methanol production routes are more diverse and involve complex processes like biomass conversion and CO2 capture.

Concerning supporting infrastructure, green methanol can directly utilize existing fuel oil infrastructure, while green ammonia requires new or modified facilities. Methanol storage and bunkering technologies are mature, whereas green ammonia needs additional liquefaction and pressurization equipment. However, given that ammonia's physical properties are similar to those of Liquefied Petroleum Gas (LPG), leveraging mature LPG storage and transportation technologies may help resolve this issue.

From a cost perspective, CO2 sourcing is key to controlling green methanol costs. Ammonia production does not require an additional carbon source, giving it a clear cost advantage. When the carbon source for green methanol comes from high-concentration CO2, its cost is comparable to green ammonia. However, if CO2 is captured directly from the air, green methanol's cost becomes significantly higher than that of green ammonia.

Regarding safety, methanol has a wide explosion limit and is highly prone to combustion and explosion. Ammonia has a narrower explosion limit and is relatively safer.

Considering carbon reduction potential, methanol is a low-carbon fuel, while ammonia is a zero-carbon fuel.

The competitive landscape between green methanol and green ammonia as marine fuels is becoming increasingly clear: the former demonstrates more prominent advantages in environmental friendliness, combustion characteristics, and infrastructure compatibility, while the latter holds certain competitiveness in terms of production processes and cost.

Source:https://mp.weixin.qq.com/s/VzhgXaTcxKT7vYcgj7fHNQ