IEA Releases

On July 30, the International Energy Agency (IEA) released its "Electricity Mid-Year Report 2025," which provides statistics for the latest 2024 data and forecasts for 2025 and 2026. The report covers global electricity supply and demand, carbon emissions, analyzes latest developments in major economies such as China, the European Union, India, and the United States, and provides the latest tracking of global market wholesale electricity prices. Key takeaways are as follows:

1. Strong Global Electricity Demand Growth to Continue in Next Two Years

Global electricity demand growth is projected to reach 3.3% and 3.7% in 2025 and 2026 respectively. While lower than the 2024 peak of 4.4%, this growth rate will remain significantly above the average of the past decade. Although slowing economic activity since early 2025 has impacted global electricity consumption, similar to 2024, high temperatures in several regions have increased electricity demand. Rising industrial demand, increased air conditioning use, data centre expansion, and ongoing electrification will continue to be the main drivers of global electricity demand growth through the end of 2026. In 2025, electricity demand growth is expected to be more than double the rate of energy demand growth, a trend set to continue in 2026.

Figure 1: Year-on-year growth rate of global electricity demand, 1992-2026 (2025-2026 are forecasts)

In 2025, electricity demand growth in China and India is expected to be lower than in 2024. China's electricity consumption surged by 7% in 2024 and is forecast to grow by 5% in 2025, a slowdown reflecting declining industrial electricity demand. China is projected to contribute 50% of global electricity demand growth in 2025, the same share as in 2024. A similar situation exists in India, where electricity demand grew by 6% in 2024 and is expected to grow by 4% in 2025. With the recovery of industrial and service sector activity, electricity demand growth in China and India is projected to rebound to 5.7% and 6.6% respectively in 2026, together contributing 60% of global electricity demand growth.

In the United States, electricity demand growth in 2025 is expected to be similar to 2024. US electricity demand grew by 2.1% in 2024, and driven by rapid data centre expansion, growth is projected to reach 2.3% in 2025 and 2.2% in 2026. The European Union, after previous significant declines, remains in a phase of moderate recovery. EU electricity consumption is forecast to grow by 1.1% in 2025, with growth accelerating to 1.5% in 2026, close to the 2024 growth rate of 1.6%. Although the contraction in EU industrial electricity demand observed in 2022-2023 halted in 2024, no significant recovery in this sector was observed by the first half of 2025.

2. Regional Divergence in Fossil Fuel Power Generation Trends in H1 2025

In the first half of 2025, coal-fired power generation declined year-on-year in China and India, while it increased in the United States and the European Union. The decline in China and India was due to both slower demand growth compared to H1 2024 and a significant increase in renewable power generation. In the United States, both renewable and coal-fired power generation grew strongly, with higher natural gas prices in 2025 prompting a shift in the generation mix from gas to coal. In the EU, despite record solar PV generation, lower wind and hydro output led to increased coal and gas-fired generation compared to H1 2024. For the full year 2025, EU coal power generation is forecast to decline compared to 2024, while India's is expected to increase, reversing the trends observed in the first half.

3. Renewables, Natural Gas, and Nuclear Power to Jointly Support New Electricity Demand

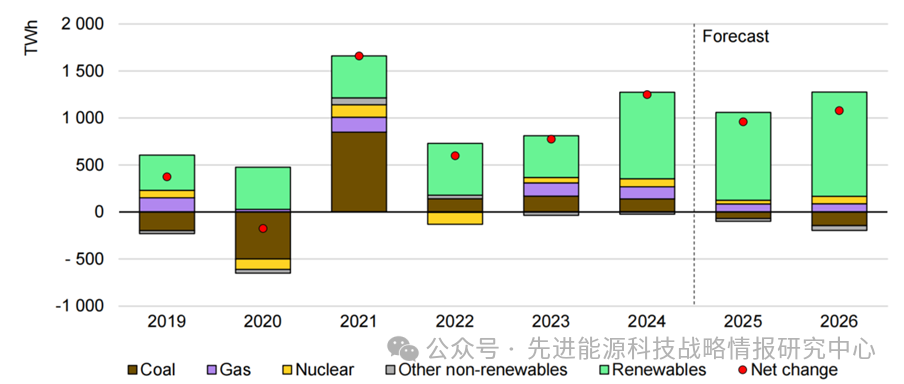

In 2025, wind and solar PV are expected to meet over 90% of the incremental global electricity demand. Global wind and solar PV generation surpassed 4,000 TWh in 2024, is projected to exceed 5,000 TWh in 2025, and reach over 6,000 TWh in 2026.

Influenced by weather patterns and economic developments, renewable generation is set to surpass coal-fired generation during 2025-2026, and coal's share in the total generation mix is expected to fall below 33% for the first time in a century. Solar PV and wind are at the core of this structural shift, with their combined share of global generation rising from 15% in 2024 to 17% in 2025 and nearing 20% in 2026.

Global coal-fired generation increased by 1.3% in 2024 and is forecast to decline slightly in 2025. Declines in China and Europe are only partially offset by increases elsewhere, particularly in the United States, India, and other Asian countries. In 2026, with continued renewable expansion and fuel switching from coal to gas in several regions, global coal power generation is projected to decline by 1.3%.

Figure 2: Annual change in global electricity generation by source, 2019-2026 (Left axis, TWh)

Global natural gas-fired generation increased by 1.9% in 2024 and is projected to grow by 1.3% in 2025, reaching a new record high. This is driven by the ongoing switch from oil to gas in the Middle East and steady growth in gas-fired generation in Asia. In H1 2025, higher US natural gas prices prompted a shift from gas to coal for power generation, while in Europe, lower wind output led to increased gas-fired generation. Global gas-fired generation is projected to grow by around 1.3% in 2026.

Global nuclear power generation is set to hit a new record in 2025 and continue its upward trend in 2026. This growth is driven by: ① Nuclear plant restarts in Japan; ② Stable output from nuclear fleets in the United States and France; and ③ New reactors coming online in China, India, South Korea, and elsewhere. Global nuclear generation is projected to grow by an average of 2% per year during 2025-2026, approaching 3,000 TWh in 2026.

4. Power Sector CO2 Emissions Set to Plateau

Global power sector CO2 emissions are expected to plateau in 2025 and decline slightly in 2026 as low-emissions sources increasingly displace fossil fuels for electricity generation. Power sector CO2 emissions grew by 1.6% in 2023. Despite higher temperatures in 2024 compared to 2023 increasing cooling demand, emissions growth slowed to 1.2%. The rapid deployment of renewables has curbed the growth of fossil fuel-based generation, but abnormal weather conditions (such as extreme heatwaves, cold spells, or below-average rainfall affecting hydro output) can cause year-to-year fluctuations in emissions. China's situation significantly influences the global trend, as it accounts for over half of the world's coal-fired generation.

Figure 3: Global CO2 emissions from electricity generation and forecast change 2024-2026 (Mt CO2)

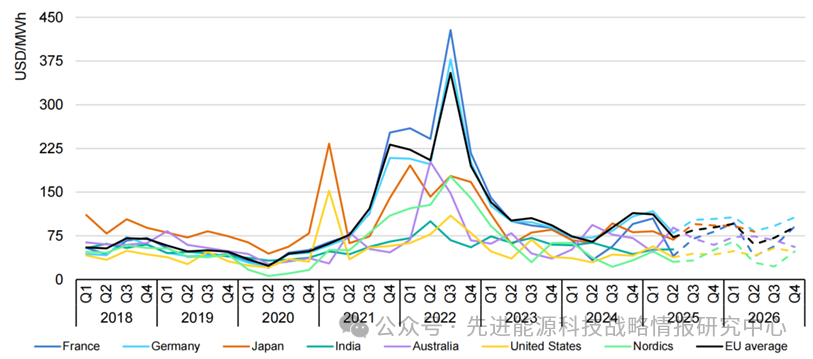

5. Rising Wholesale Prices in Some Regions Highlight Need for Enhanced Power System Flexibility

In the first half of 2025, average wholesale electricity prices increased year-on-year in several markets. Wholesale prices in the EU and the United States rose by approximately 30%-40%, primarily due to higher natural gas prices; average prices remained below 2023 levels but were higher than in 2019. In contrast, wholesale prices in India, Australia, and others fell by about 5%-15% compared to 2024. The occurrence of negative prices continued to increase. The share of hours with negative prices in wholesale markets in Germany, the Netherlands, and Spain reached 8%-9%, up from 4%-5% in 2024. This reflects insufficient power system flexibility and underscores the need for appropriate regulatory frameworks and market designs to deploy solutions like energy storage and demand response.

Significant regional disparities persist in electricity prices for energy-intensive industries. After peaking in 2022, prices for energy-intensive industries in the EU fell steadily in 2023-2024 but are expected to rise again in 2025 due to higher wholesale prices. The average price for energy-intensive industries in the EU in 2025 is about double that in the United States and 50% higher than in China. Back in 2019, EU prices were only 50% higher than in the US and 20% higher than in China. Persistently higher electricity prices continue to pressure the competitiveness of the EU's energy-intensive industries.

Figure 4: Quarterly average wholesale electricity prices in selected regions, 2018-2026 (USD/MWh)

6. Power System Security and Resilience are Crucial

Recent blackouts in various parts of the world highlight that electricity security is critical for modern economies and societies. On February 25, 2025, a transmission system failure in Chile left 99% of the country's 20 million people without power for up to 17 hours. On April 28, a blackout in Spain and Portugal lasted over 10 hours, affecting tens of millions of people and numerous businesses. As electrification extends across all sectors of the economy, and power systems expand and become more complex, ensuring the security and reliability of electricity supply is more important than ever. Robust grid infrastructure, resilient supply chains, and a diversified portfolio of flexibility resources and technology-based stability solutions are core pillars of electricity security. As power systems evolve, stakeholders urgently need to take measures such as updating grid codes, capacity adequacy requirements and regulatory frameworks, and adapting operational practices.

Source:https://mp.weixin.qq.com/s/q9GW3bSDO5LZwS3Tts1XKA